10 Simple Techniques For Car Insurance - Get An Auto Insurance Quote - Allstate

Vehicle drivers who only have a jr certificate aren't allowed to drive within the 5 districts of New York City, so it's typically useful to bypass the junior vehicle driver's certificate till she or he certifies for a senior permit. Outside of New York City, the jr certificate is legitimate with a series of time limit and also guest constraints specific to each area.

Insurance Coverage in Long Island City has to do with $77 much more expensive than it is for the remainder of the U.S. Although these are the typical vehicle insurance coverage prices in Long Island City, you could wind up paying something various. Insurance provider weigh a variety of factors when determining how much to bill you for cars and truck insurance coverage.

Ordinary Cars And Truck Insurance Coverage Rates by Gender $153$178 Although women typically pay much less than men do for auto insurance, this is not the case in Long Island City, where female motorists pay around $25 even more monthly. Average Vehicle Insurance Coverage Prices by Driving Record $150$129Not Enough Information, Not Sufficient Information Your driving document can have a big effect on your vehicle insurance prices. cheaper.

Vehicle and also van chauffeurs will certainly see rates of around $153 for auto insurance policy, while car owners typically pay around $157 a month. Automobile age likewise plays a duty in your monthly payment. Normally, more recent cars are mosting likely to cost the most to guarantee. insured car. When your cars and truck is around 5 years old, you could begin to see your rates slide back down a little.

accident insurance low cost auto insurance

insurance affordable cheaper car insurance credit score cheaper auto insurance

Typical Car Insurance Prices by Partnership Condition $162$126 More often than not, those who are presently married will pay somewhat much less for automobile insurance. This happens because insurer frequently expand special price cuts to insurance policy holders with multiple automobiles that get on the very same plan. In Long Island City, the difference in prices based upon relationship condition can be as high as $36 a month.

If you rent your home or house, expect to pay around $13 a month more than if you have your own home in Long Island City. Those who live with their moms and dads, nevertheless, can expect to pay a bargain greater than their equivalents that rent out or possess. Depending on your insurance policy business, they may provide you a price cut if you pack your house or tenants insurance coverage with your automobile policy.

Unknown Facts About Easy Ways To Save Money On New York Car Insurance

In Long Island City, the prices for auto insurance coverage have been blended over the past few years. They did, nonetheless, surge from $144 in 2019 to $178 in 2021. How does Long Island City contrast to bordering locations?

How can I find the most inexpensive automobile insurance in Long Island City? The only method to know for certain what your rate will be is by asking for a quote from car insurance policy business.

Put in your ZIP listed below, answer a few concerns, and also you'll be contrasting the most inexpensive quotes from the many cars and truck insurer that use car protection in Long Island City. Long Island City Insurance policy FAQs Automobile insurance firms take a vast range of factors right into factor to consider when determining your month-to-month payment. cars.

Regional regulations, auto parking circumstances, and crime prices-- every one of which can transform from city to city-- play a huge function in the rates that cars and truck insurer might charge for insurance coverage. Given that the elements that enter into calculating your regular monthly repayment differ from one person to another, there isn't one business that will certainly constantly supply the most inexpensive price to everyone.

As a matter of fact, you can swap business at any factor, regardless of just how much time is left on your present protection. So, whether you're transferring to Long Island City or simply curious regarding rates in your location, why not take 10 mins to see if Contrast. com can save you money?.

In this short article, we'll check out how typical automobile insurance rates by age and also state can change. We'll also take a look at which of the best auto insurance firms use excellent discounts on auto insurance coverage by age as well as compare them side-by-side. Whenever you look for auto insurance policy, we advise getting quotes from numerous suppliers so you can compare insurance coverage as well as prices - prices.

How Aaa Northeast: Home can Save You Time, Stress, and Money.

Why do average cars and truck insurance coverage rates by age vary so a lot? 5 percent of the population in 2017 however stood for 8 percent of the overall expense of automobile crash injuries.

The price information originates from the AAA Structure for Traffic Safety, and it represents any crash that was reported to the authorities. The ordinary premium data originates from the Zebra's State of Automobile Insurance report. The prices are for policies with 50/100/50 obligation protection limitations and a $500 deductible for detailed and also crash insurance coverage.

According to the National Highway Traffic Safety And Security Management, 85-year-old males are 40 percent more probable to get right into a mishap than 75-year-old males (low cost). Taking a look at the table over, you can see that there is a direct correlation between the collision rate for an age team as well as that age's typical insurance policy costs.

Keep in mind, you may discover better prices via an additional business that does not have a details pupil or elderly discount rate. affordable auto insurance. * The Hartford is only offered to participants of the American Organization of Retired People (AARP). Nonetheless, insurance policy holders can include more youthful vehicle drivers to their plan as well as get discount rates. Typical Automobile Insurance Policy Fees And Also Cheapest Service Provider In Each State Due to the fact that auto protection rates vary a lot from one state to another, the supplier that offers the most inexpensive auto insurance coverage in one state might not use the most affordable coverage in your state.

As you can see, average automobile insurance coverage costs vary widely by state. Idahoans pay the least for cars and truck insurance, while motorists in Michigan shell out the huge dollars for protection.

If you live in downtown Des Moines, your premium will probably be even more than the state standard (auto). On the various other hand, if you reside in upstate New York, your car insurance plan will likely cost much less than the state standard. Within states, auto insurance costs can vary widely city by city.

Our Best New York Homeowners Insurance - Trusted Choice Statements

The state isn't one of the most expensive total. Minimum Coverage Demands The majority of states have monetary responsibility laws that need drivers to carry minimum vehicle insurance policy coverage. You can just forego insurance coverage in 2 states Virginia and also New Hampshire yet you are still economically liable for the damages that you create.

No-fault states include: What Various other Elements Influence Automobile Insurance Coverage Rates? Your age as well as your home state aren't the only things that impact your prices. Insurance providers make use of a range of variables to determine the price of your costs. Right here are a few of the most vital ones: If you have a tidy driving document, you'll discover far better prices than if you have actually had any recent crashes or web traffic violations like speeding tickets.

Some insurers may offer reduced rates if you don't use your auto much. Others offer usage-based insurance that may save you money. Insurance companies factor the probability of a car being swiped or damaged in addition to the cost of that vehicle into your costs. If your auto is one that has a possibility of being swiped, you may have to pay even more for insurance.

In others, having negative credit can cause the expense of your insurance coverage costs to climb substantially. Not every state permits insurance firms to use the gender listed on your motorist's permit as a determining consider your costs. In ones that do, women vehicle drivers typically pay a little much less for insurance coverage than male drivers - cheap car insurance.

insurance affordable suvs business insurance liability

Why Do Vehicle Insurance Policy Prices Change? Looking at ordinary car insurance prices by age as well as state makes you wonder, what else impacts rates?

An at-fault crash can elevate your rate as high as 50 percent over the next 3 years. If you were convicted of a DUI or committed a hit-and-run, your prices will rise much more. You don't have to be in a crash to experience rising prices. Overall, car insurance policy often tends to obtain much more pricey as time goes on.

An Unbiased View of Direct Auto Insurance

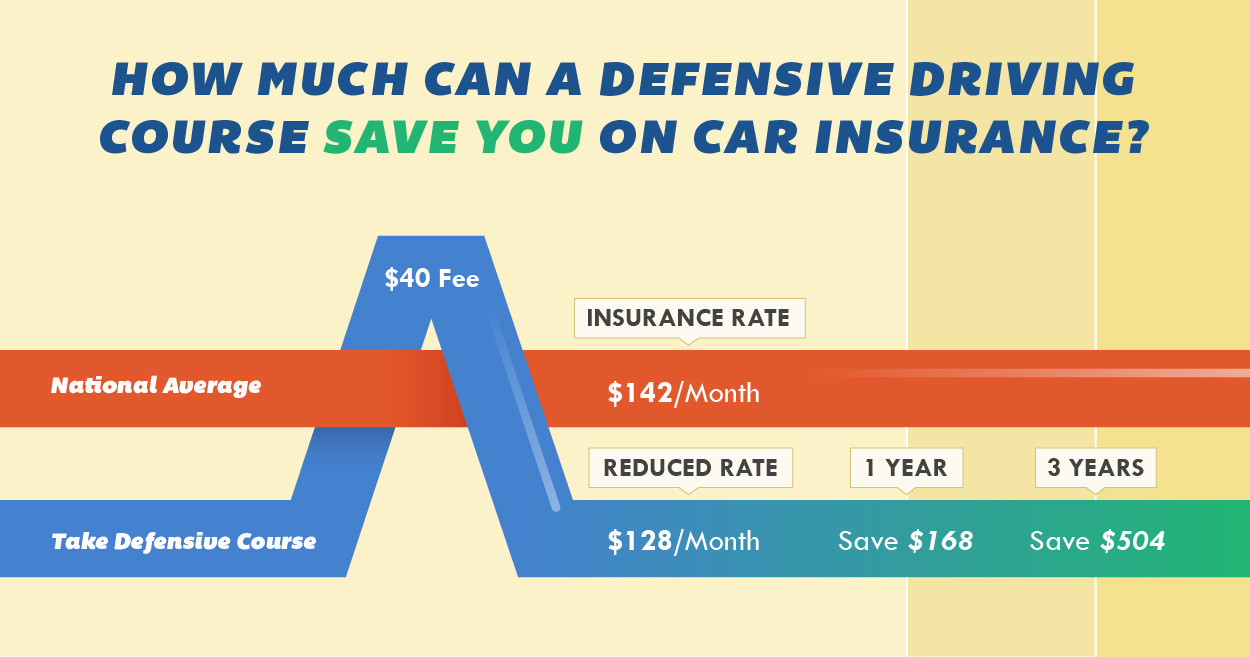

Luckily, there are a number of various other discount rates that you could be able to take advantage of today. Right here are a few of them: Several firms offer you the biggest discount for having an excellent driving history. Called bundling, you can get reduced rates for holding even more than one insurance coverage plan with the same company.

Home owner: If you have a home, you can get a home owner discount from a number of service providers. Obtain a discount rate for sticking to the exact same business for several years. Right here's a secret: You can always compare rates each term to see if you're obtaining the very best cost, despite having your loyalty price cut.

However, some can likewise elevate your rates if it transforms out you're not a great chauffeur. Some business give you a discount rate for having a great credit rating. When looking for a quote, it's a great concept to call the insurance firm and also ask if there are anymore discount rates that relate to you.

cheap car affordable auto insurance low cost auto

The typical cost of a full coverage insurance policy in New York City is $4,822 per year. Rates are greater in NYC simply since of just how many people live there, and the already-high expense of living.

We don't sell your information to 3rd parties. The simplest method to save money on your car insurance policy is by contrasting rates between leading business in the New York City location. Our specialists below at Policygenius can aid assist you to the protection that works finest for you. Key Takeaways Main Road America has the least expensive ordinary prices in New york city City at $1,599 each year for complete insurance coverage.

Auto insurance policy rates are various for everybody. Personal information like the auto you drive, the amount of protection needed, as well as also whether you're single or wedded effects your rates - cheaper. To conserve cash on cars and truck insurance policy, it's always an excellent here suggestion to compare quotes and pick the insurance coverage that works ideal for your insurance requires.

Understanding Ssi - Living Arrangements Fundamentals Explained

If you live in an area that has a higher criminal activity rate, opportunities are you're paying a lot more for cars and truck insurance coverage. ZIP codes are one of the greatest elements utilized to identify car insurance coverage prices.

You want a firm with experience as well as client solution that pays attention to your requirements. When it's time to file an insurance claim, you expect your insurer to make the procedure as seamless as possible - liability. At Policygenius, we can assist you see quotes from top firms, so you can pick one that satisfies all your needs.

https://www.youtube.com/embed/M8d9vPAvIXk

In New York City, a solitary ticket for auto racing can boost your prices by $1,800 over 3 years, and also other offenses, like a DUI or a hit-and-run, can boost your rates even a lot more. Below are the average vehicle insurance coverage prices for drivers in New york city City with speeding tickets or various other relocating violations on their driving record. business insurance.